Features and benefits of a Nedbank ID login

It's quick and simple to set up

Both new and existing clients can register for a Nedbank ID in just a few quick steps on the Money app, or online.

It's easy to remember

Your username and password is completely up to you, meaning you can create a combination that is easy to remember.

Your security is guaranteed

A Nedbank ID login uses the latest technologies to keep your information and account acitivities secure whenever you are banking online or using any of our mobile apps.

It's a truly enriched experience

Nedbank ID allows you to enjoy a digital banking experience that is uniquely tailored to your profile, products and services while also giving you access to the latest features and lifestyle benefits.

Don't have a Nedbank account yet?

If you are thinking of joining Nedbank, we recommend you download the Money app for easy access to all products and services from the comfort of your smartphone.

You can register for a Nedbank ID username and password directly from the Money app. Alternatively, you have the option of setting up your Nedbank ID online.

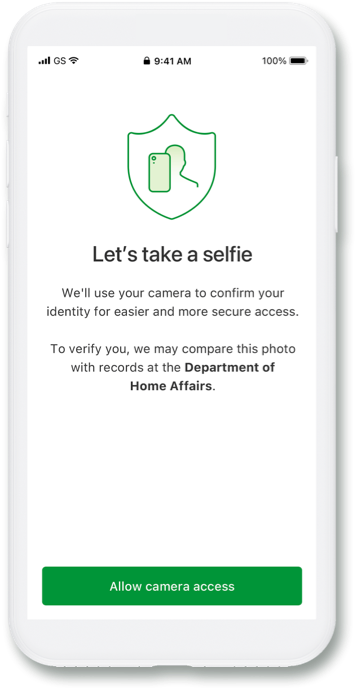

How to register on the Money app

- Download the Nedbank Money app.

- Select Register for your Nedbank ID.

- Enter your personal details and link your account with your bank card and ATM PIN or with your profile number, PIN and password.

- Accept the Approve-It message.

- Create a Nedbank ID name.

- Create a Nedbank ID password.

- Confirm your new Nedbank ID.

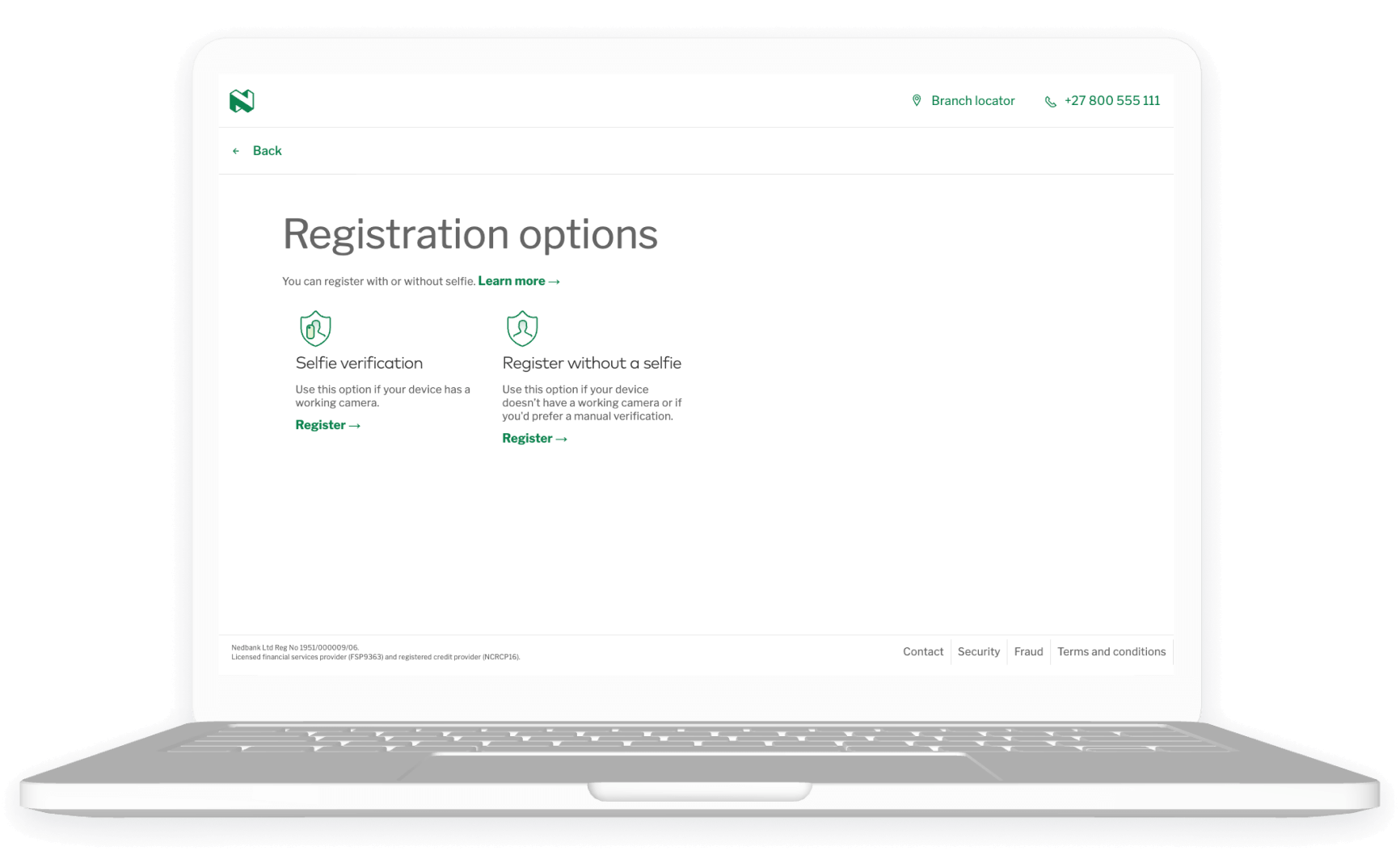

How to register on Online Banking

- Go to secured.nedbank.co.za and select Register.

- Enter your South African ID number or foreign passport number.

- Accept the Approve-it message that we'll send to your cellphone.

- Create your Nedbank ID username and password.

- Link your profile number, PIN and password (your old internet banking details) to your Nedbank ID.

Nedbank ID FAQ

Access an enhanced banking experience with your Nedbank ID username and password.

Managing your Nedbank ID

For your security, remember to keep your Nedbank ID login details private at all times. To view or change your Nedbank ID username and password, follow these steps in our how-to guides.

Help and support

Chat to Enbi - your 24/7 assistant

on the Money app or Online Banking

Get the Money app

For a secure and convenient way to manage your money, open an account, get a loan, or even buy gift and prepaid vouchers: get the Nedbank Money app.

Get the Money app Learn more