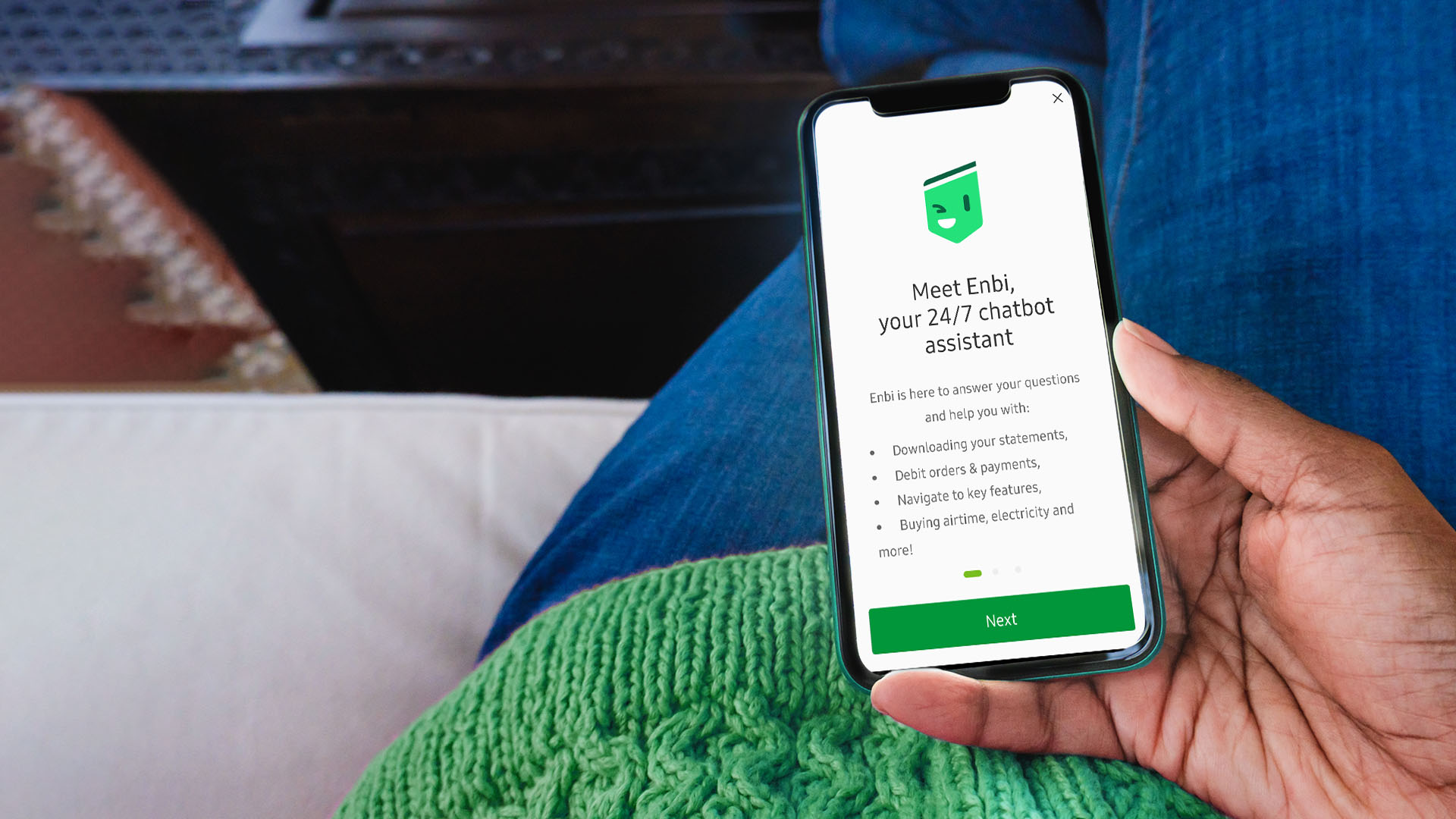

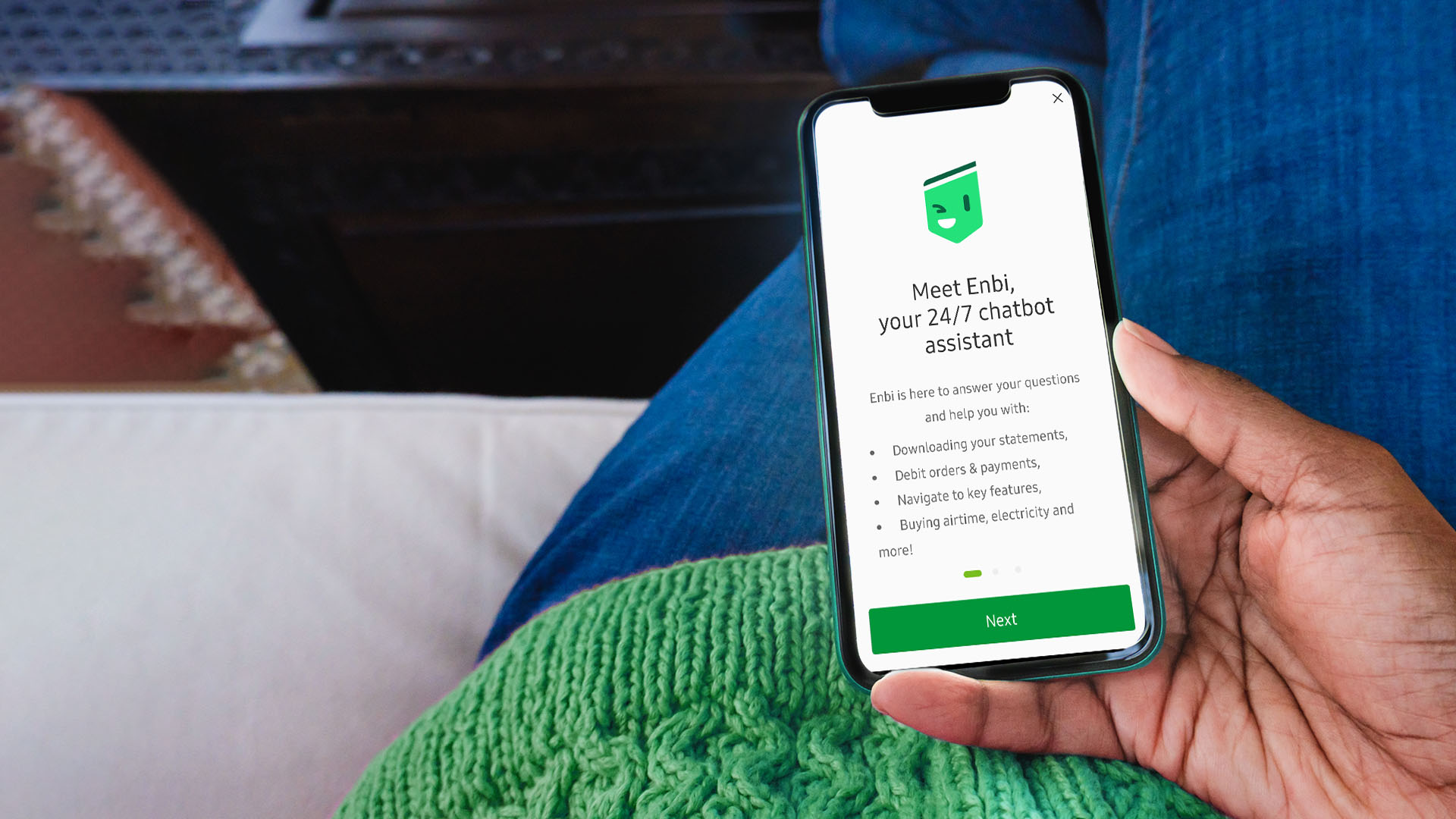

Whether you're a Nedbank client or soon to be, #AskEnbiFirst

Instant responses anywhere, at any time of day

Easily available online, on the Money app or Online Banking

Quick and secure access to your cards, statements, payment options and more

Get the latest news, offers and banking features directly from your chat

Experience simpler, smarter banking

- Find the Nedbank product you need in just a few clicks.

- Get direct access to our digital banking features.

- Learn how to get things done on your app or Online Banking.

- Enjoy voice-to-text transcription for even smoother conversation.

- Enbi can also offer you added guidance and support if you are visually impaired.

And if it happens that Enbi doesn't have the answer, you'll be transferred to a human colleague for specialised assistance without a hint of hesitation.

Your anytime-anywhere chat service

Enbi is always available to share information about our products and services. And if you bank with us, Enbi can help you access your accounts securely when you are signed in to the Money app or Online Banking.

New to Nedbank?

Simply click on the green chat icon on this page to chat with Enbi.

For an even more personalised experience with convenient access to our services, offers and shortcuts to the products you need, we recommend you download the Money app and register for a Nedbank ID (your unique username and password) so that Enbi can get you well on your way.

Here's why we love Enbi – and we think you will too

That's 22 million service requests, from over 1.8 million clients. Proof that Enbi's fast becoming Nedbank's number 1 digital banking colleague, and our clients trusted aide.

From guiding new clients around their banking profiles to showing seasoned ones the quickest way to a dashboard, tax certificate, or to book an appointment with a banker – Enbi's doing the most.

Spend less time on the phone or at a branch. With less than 10% of clients having asked to speak to an agent after interacting with Enbi, we're pretty sure your everyday questions are in good hands.

Do less. Live more. Just ask Enbi.

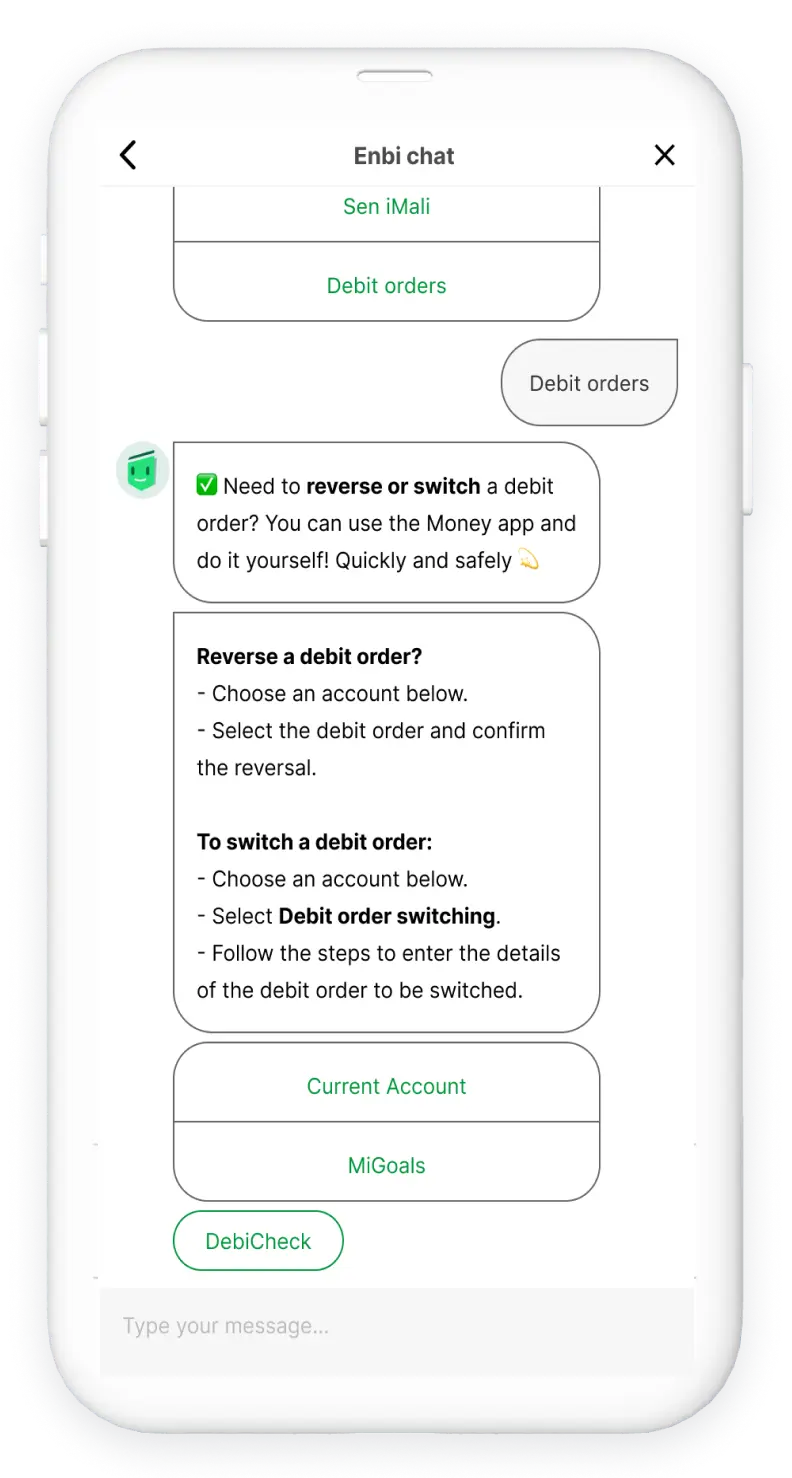

Trust us. There's never any need to take more time out of your day for banking admin than you'd like to. Need to open a new account? Reset your forgotten password? Reverse a debit order? Download a proof of payment, or update your ATM and card spend limits? Go on and #AskEnbiFirst

Frequently asked questions

We've gathered a few of the questions that some have asked, and hope you'll find them useful.