Our operational footprint

Managing our own carbon footprint and achieving our climate targets: To establish credibility as partners in our clients’ transition to net zero, we lead by example. Since 2009, we have achieved carbon-neutrality in our operations by voluntarily offsetting our residual carbon footprint. Additionally, we have set robust targets to decarbonise our operations, emphasising a shift towards renewable energy and are proactively managing our operational footprint.

Energy and carbon-reduction target progress

Energy target

Nedbank’s target is to reduce energy consumption by 30% by the end of 2025, based on 2019 levels. Nedbank is accordingly targeting annual electricity consumption below 97 000 MWh (absolute target) or 3 320 kWh per FTE (intensity target), whichever is met first. Renewable Energy Target Nedbank have successfully achieved the 2025 energy consumption a year earlier in 2023. We are also making considerable progress towards our renewable energy aspirations. However, we foresee that due to the limited availability of renewable energy stock in the market, we are likely to achieve 20% of renewable energy by 2025. The current constraints are that we currently can only wheel to our Eskom supplied campuses. A further significant unlock would be to wheel through municipalities and landlords into Nedbank’s occupied portfolio without layering costs. Taking these challenges into account, we are actively exploring alternative solutions and opportunities, which are expected to help us leapfrog our current 2025 target into the near future.

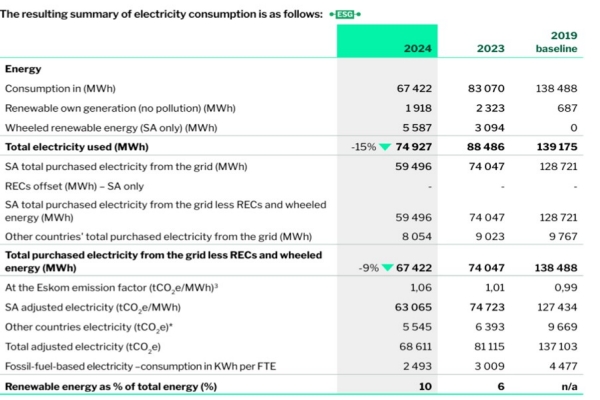

Energy consumption

In 2024 Nedbank continued efforts to diversify our electricity use, with a focus on procuring electricity from cleaner sources. With the expansion of our on-site renewable energy sources, and the use of renewable energy certificates1 (RECs) that verify our wheeled2 renewable electricity consumption, we have further reduced Nedbank’s impact on the environment. Our non-renewable energy consumption decreased by 9% year-on-year, and renewable energy now represents 10% of our total energy use, up from 6% in 2023.

Carbon footprint calculation methodology for the financial year ending 31 December 2024

Carbon footprint measurement

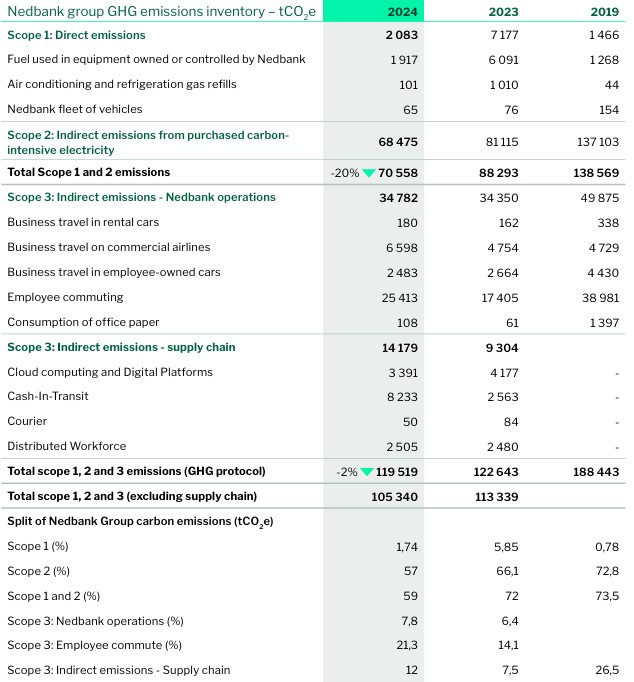

From 2023 to 2024 our reported total GHG emissions have decreased by 2% in absolute terms. Carbon emissions per FTE have decreased by 2%, from 4,4 tCO2 e/FTE in 2023 to 4,43 tCO2 e/ FTE in 2024. The significant reduction in scope 1 direct emissions can be linked to load-shedding suspension that occurred during the majority of 2024, thereby reducing the dependency and use of generators. Although the Eskom grid emission factor increased from 1,01 tCO2 e per MWh to 1,06 tCO2 e per MWh in 2024; we achieved lower scope 2 emissions. This was due to our efforts in reducing electricity consumption through workspace optimisation by consolidating floor space on campus site and reduced sites. Furthermore, we ramped up our green energy wheeling compared with the previous year. Emissions per m2 increased by 0,04 tCO2 e to 0,27 tCO2 e per m2 in 2024, levels because of reduced floor space of 22 623 m2 or reported buildings compared with 2023. The slight increase in scope 3 Nedbank indirect emissions (excluding supply chain scope 3 emissions) is due to more employees returning to office and higher business travel in 2024, compared with 2023. The notable rise in supply chain-related emissions was linked to the inclusion of a major CIT supplier.

Own operation glidepaths

Our glidepath is the decarbonisation trajectory for reducing our total carbon emissions each year, for which we are on track. These projections show how we plan to achieve our goal of carbon-neutral facilities, by 2035, through reducing our direct carbon emissions and monitoring indirect emissions.

Nedbank own emissions

Nedbank group GHG emissions inventory – tCO2 e

Our successes serve as a testament to the commitment of every employee to the reduction goals. The table below provides further information about Nedbank’s own Scope 1, 2 and 3 emissions.

Carbon offset projects

Carbon offset inventory

Our carbon-neutral positioning enables us to enhance our client value proposition and create synergies, partnerships, and collaborations with organisations that share our values. A 'reduce first, then offset' strategy underpins these efforts. Internal awareness initiatives and behavioural change drive our own carbon reduction efforts. Only then do we endeavour to use carbon credits to offset our remaining carbon emissions. Our commitment to credibility in carbon offsetting extends to our preference for verified carbon credits, rigorously audited by credible and independent bodies under recognised carbon standards, ensuring transparency and accountability in our carbon offsetting initiatives. In addition, we prefer to support carbon offsetting projects with verifiable carbon credits that have added sustainable development impacts. Consequently, we connect with African projects that have positive social and natural advantages. The following are some of the carbons offset projects we support.

Reduction targets

Most targets have been met and maintained before the target date. New targets were set using 2019 data as the new base for the 2020–2025 period (the previous base year was 2013). The data per full-time employee (FTE) could be artificially low due to fewer employees being in offices because of hybrid work practices. To counter a potential artificial decrease in the future, the new targets are both gross and consumption target/ratio and/ or normalised per FTE target.

We aim to continuously improve the scope of our facility level Emission s reporting and have accordingly enhanced our suite of scope 3 emissions by expanding our boundaries to include a wider range of our suppliers. Our aim is to continually improve the quality of data sets from these and other suppliers. We remain committed to setting reduction targets related to our facilities and keeping track of these goals to decrease our operations’ impact on the environment and help reduce the physical risks caused by climate change.

These targets clearly state our resource consumption levels and carbon emissions. Our aim is to reach or exceed our emission reduction targets, and to use these targets as a framework for responsible use and management of natural resources across our different operational levels: the whole group, smaller clusters, business units, teams, and individuals. We ensure regular communications with our employees to foster an understanding of their significant role in decreasing the environmental impact of our operations. Our emissions reduction targets form part of our performance contracts with our employees, reinforcing their significant role in our combined sustainability endeavours. We place emphasis on the correctness of the scope and location of what we quantify when evaluating our progress against our emissions reduction targets.

Nedbank's environmental compliance:

- Total Number of Environmental Incidents - 0

- Total Number of Environmental Fines and/or Non-Compliances - 0

- Total Number of Environmental Complaints - 0

- Total monetary losses from legal proceedings associated with environmental regulations - R0.00

- Total monetary losses from environmental law violations - R0.00

- Certified ISO14001: As a financial institution we align to the standard, but due to our limited operational impact not certified.

- Percentage of the suppliers' operations covered by the ESG criteria 100%

- Metrics on supplier non-compliance with environmental expectations - 0

- Metrics on corrective actions to mitigate suppliers' non-conformance about environmental issues – 0

- Significant negative environmental impacts found in the supply chain - 0 - As a financial institution our suppliers do not have a significant impact on the environment.