What does an air fryer, washing powder and your favourite snack have in common?

You can find them all on Avo SuperShop, of course! We have everything you need, with incredible choice at the very best prices. Now that's living the good life!

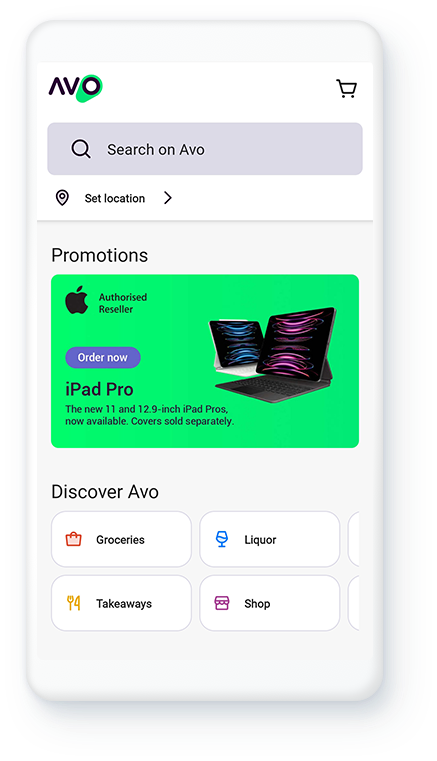

What is Avo SuperShop?

A super-secure, hyper-personalised shopping experience with everything you need – and everything you never knew you wanted. Avo SuperShop is here to bring you more of the good life, featuring all your favourite brands and more in a single, secure space. Now you can hold convenience in the palm of your hand.

Sign up today using the Money app and access exclusive deals.

Why shop on Avo?

Super deals await

SuperShop incredible deals from South Africa's top brands across technology, appliances, and more. As a Greenbacks member, you'll receive exclusive savings.

Swap your points to shop

It's super easy to exchange your Greenbacks for AvoPoints – and you're guaranteed exclusive deals. 36 Greenbacks = 1 AvoPoint.

Tap in to top up

Stay connected with airtime and data from your network provider, or keep the lights on with prepaid electricity. We'll even hook you up with vouchers for all your favourites!

Take your car buying into hyperdrive

SuperShop your next set of wheels with Avo Auto. Explore thousands of cars, apply for finance and find out what car payment you can afford – all in one place.

Get powered on your terms

Avo Solar offers you budget-friendly solutions of the highest quality and performance. Take your power back. Get off the grid with an expertly installed alternative-energy solution.

Banking services in your pocket

Get the convenience of banking and shopping all in one go. Whether you need a personal loan or funeral cover, you can get it all on Avo – no matter where you bank. Now that’s super convenient.

All credit and loans are backed and supported by Nedbank.

Sign up now

Download Avo on Google Play, the App Store, or at avo.africa. You can also access the SuperShop directly through your Nedbank Money app.

Frequently asked questions

Read up, sign up - and get to shopping