Yes, you can plan for the school year

Yes, you can plan for the school year

Staff writer

2 mins

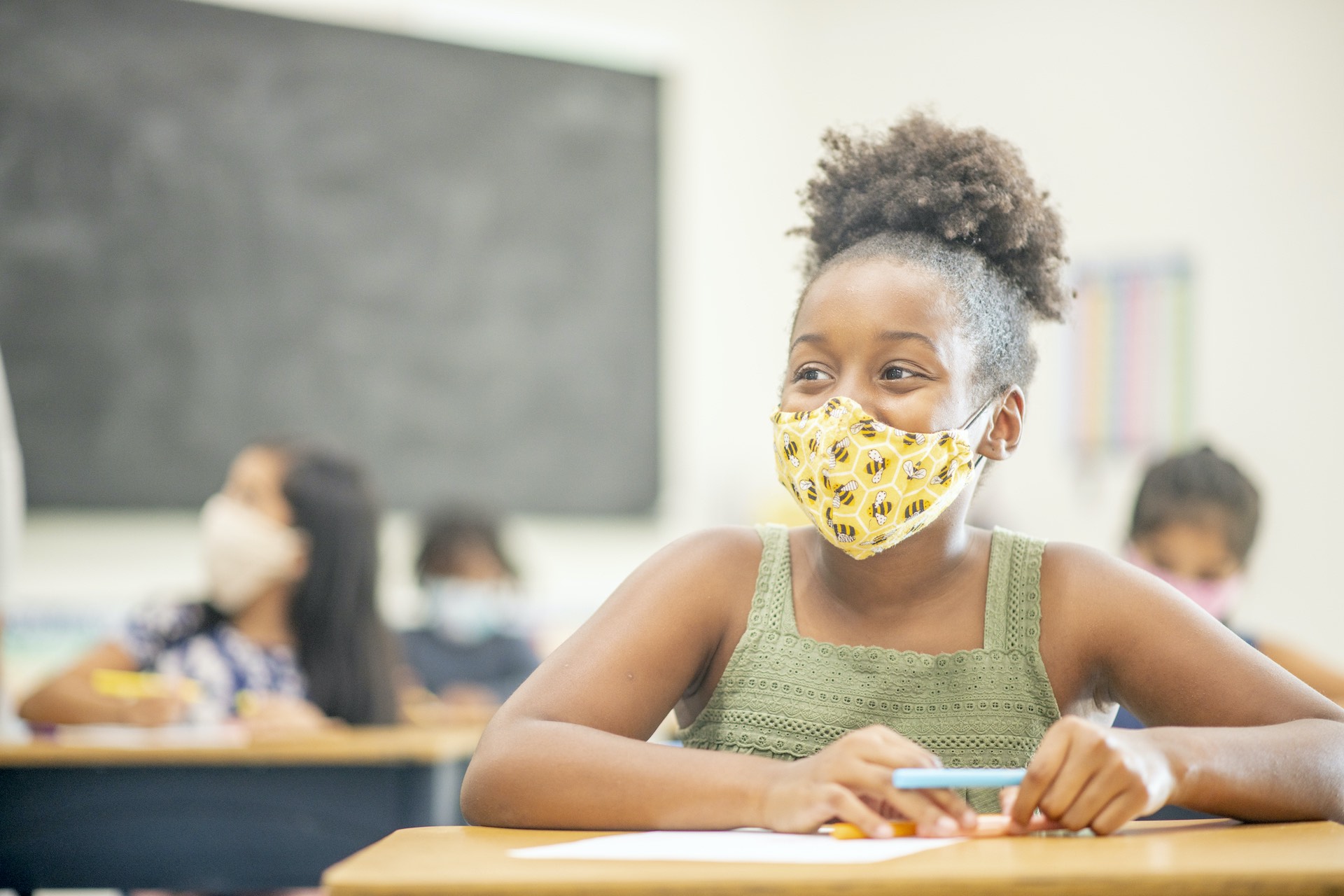

Has the stop-start back-to-school routine got you in a muddle over what school supplies you’re going to need?

The start of the school year is hard enough without the uncertainty caused by lockdown. This year, school expenses could involve more than just fees, supplies and uniforms. Remote schooling puts all kinds of new pressures on parents who want to ensure their kids’ education can continue seamlessly.

Unsure future of schooling

But with the opening of schools for physical classes being on-again-then-off-again, it’s almost impossible to plan. Especially if you like to buy all the year’s essentials upfront. This can be a significant expense, so taking out a personal loan is an option for many.

So, how do you calculate what you need, with so many unknowns? Your home technology setup could need an upgrade, so that schooling can continue unhindered if we see repeated lockdowns and school closures. But should it take priority over new school shoes?

You can still be prepared

The last thing you want is to be caught off guard. Your best approach is to prepare for both scenarios. Start by drawing up a list of what the priority buys are for physical classes.

Also, you have to ensure a proper home-schooling setup, in case schooling takes place digitally. This also needs a to-buy list. You’ll then be able to compare costs for both instances and look around for the cheapest options.

Is permanent homeschooling an option?

Of course, it is possible to remove the uncertainty all on your own. You could investigate homeschooling – whether for the rest of your child’s school education, or just until vaccine coverage has made classrooms safe from the Covid-19 threat. This cuts costs like school fees and uniforms, but your online learning support tools need to be up to scratch.

Whether homeschooling is right for you and your children also depends on your personal circumstances. Is there a qualified stay-at-home parent or tutor to conduct lessons?

There are other factors to consider, too – like how will your child’s social development be affected, and how do you ensure that they have the same cultural and sporting opportunities as they would at school?

Homeschooling’s biggest drawcard right now is its predictability – but taking this course is a huge step that will have long-term consequences, so don’t make any snap decisions. Before you decide that this is the best solution for your child’s education, we strongly advise you look for professional advice.