You can call the Nedbank Contact Centre on 0800 555 111. When you call, make sure that you have your payment reference or meter number on hand.

How to buy water on the Money app

- Log in to the Money app and go to Transact.

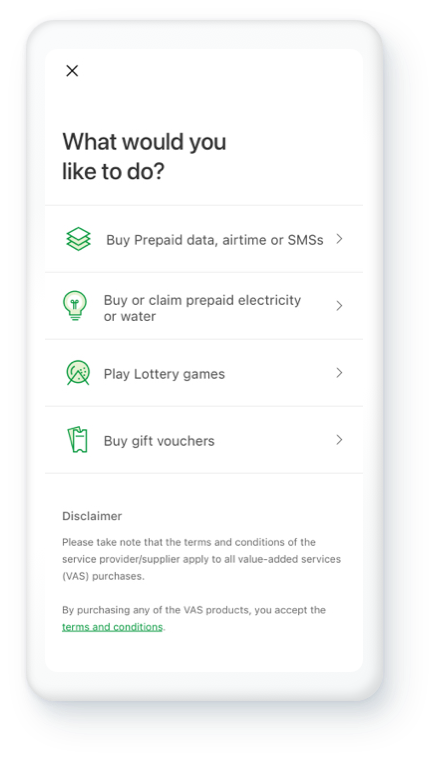

- Tap on Buy and select Buy or claim prepaid electricity and water.

- Select Buy or claim water and choose Prepaid water.

- Enter your water meter number.

- Save this meter number as a recipient for future purchases.

- Enter the amount you want to buy.

- Select the account you want to buy from.

- Tap on Next and then on Buy.

- You will now see your voucher number and you can choose how you want to share it.

- Tap on Finish.

How to buy water on Online Banking

- Log in to your Online Banking profile and go to Transact.

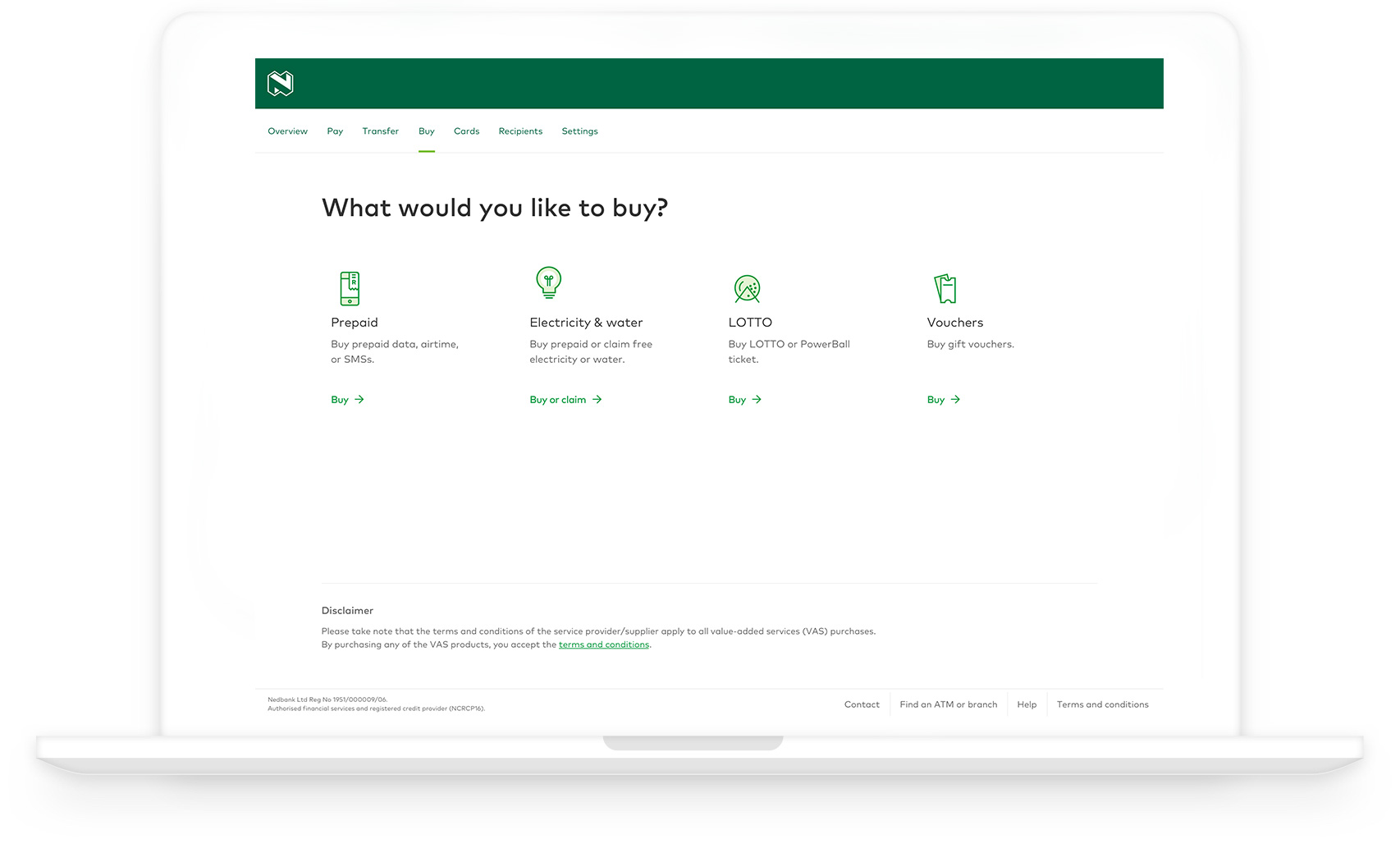

- Click on Buy and select Buy or claim prepaid electricity and water.

- Select Buy or claim water and choose Prepaid water.

- Enter your water meter number.

- Save this meter number as a recipient for future purchases.

- Enter the amount you want to buy.

- Select the account you want to buy from.

- Click on Next and then on Buy.

- You will now see your voucher number and you can choose how you want to share it.

- Click on Finish.

The municipalities we cover

You can top up your prepaid water meter from the following areas, towns and municipalities. Once purchased, the voucher code will become available for use immediately.

Skip the queues. Get your prepaid water tokens online.

For water on-tap, buy your prepaid water in just a few quick taps

Easy access

You can buy a top-up for your water meter any time if you have a digital banking profile.

Saves time and paper

Your prepaid water token will be sent directly to your phone for instant top-up (no paperwork, no waiting time).

Easy to manage

Buy exactly how much you want directly from your bank account, anywhere, anytime.

FAQs

Help and support

Chat to Enbi - your 24/7 assistant

on the Money app or Online Banking

Get the Money app

For a secure and convenient way to manage your money, open an account, get a loan, or even buy gift and prepaid vouchers: get the Nedbank Money app.

Get the Money app Learn more