Make secure online payments without having to use your card details

Benefits of a Nedbank virtual card

More security

Make payments directly from your account using your virtual card details. Perfect for online and app purchases!

More control

Set daily, weekly or monthly spend limits and decide how long you’d like each virtual card to remain active.

More convenience

You can block and delete your virtual card at any time or create a new one instantly without impacting your linked account.

More rewarding

Over and above the added peace of mind, you’ll earn Greenbacks and other membership rewards the same way as you would on your regular card.

Multiple benefits

Use your virtual cards for once-off purchases or upload them as payment options for online subscriptions and app payments (eg Uber, Netflix, Superbalist).

Free of charge

To create up to 5 digital cards on your credit or bank account at no cost, simply log in to the Money app and follow the easy prompts.

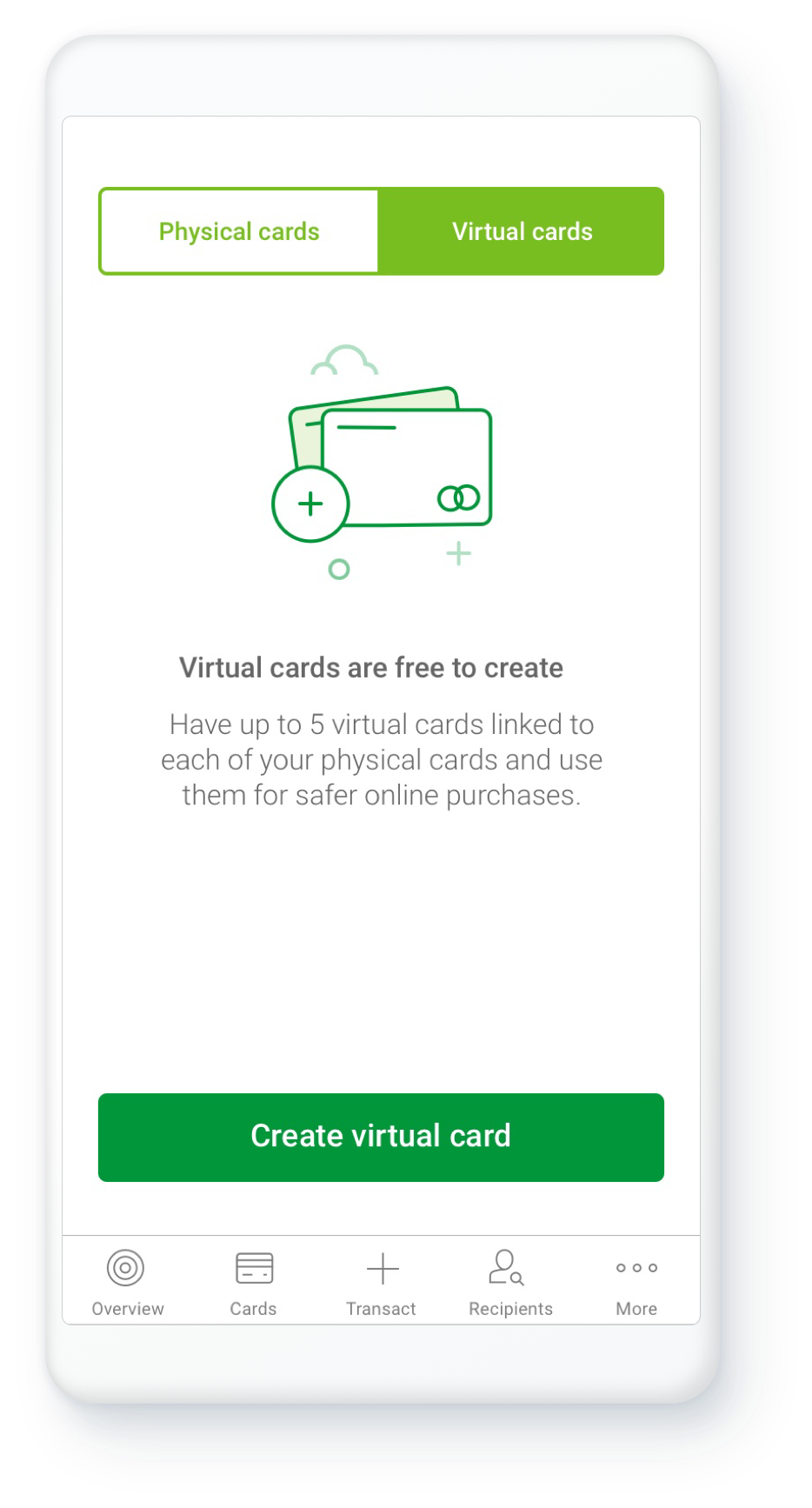

How to create your virtual card

- Log in to the Money app.

- Select Cards from the menu.

- Select Virtual cards, then Create virtual card.

- Read the overview and select Get started.

- Select the account you’d like to link your virtual card to.

- Select Add virtual card.

- Name your card.

- Choose an expiry date.

- Set your spending limit.

- Accept the terms and conditions.

FAQs

Help and support

Chat to Enbi - your 24/7 assistant

on the Money app or Online Banking

Get the Money app

For a secure and convenient way to manage your money, open an account, get a loan, or even buy gift and prepaid vouchers: get the Nedbank Money app.

Get the Money app Learn more