- Incoming international payments

- Outgoing international payments

- Western Union

Secure international payments

We use the Society for Worldwide Interbank Financial Telecommunication network (SWIFT) to ensure the security of your international payments. Receive money from family and friends, pension payments from an offshore investment, or payments for goods and services.

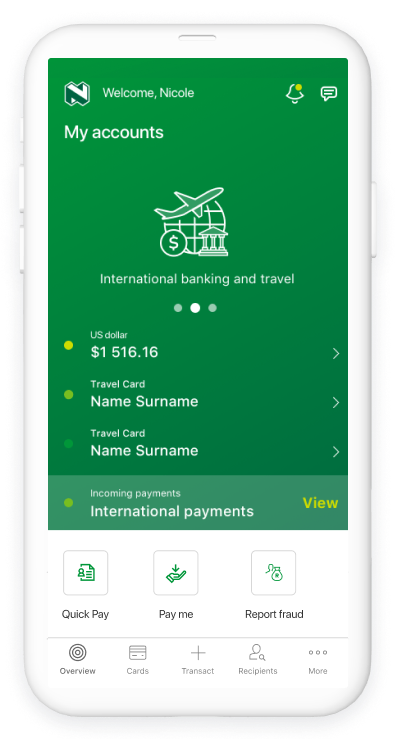

You can now receive international payments on the Money app and Online Banking.

Key features

Convenience

Take full control of incoming payments on the Money app or Online Banking (currently available to individual clients only).

Simplicity

International funds will be paid directly into your Nedbank account. Simply give the sender these bank details: Nedbank’s SWIFT code (NEDSZAJJ), your name and your account number.

Security

View all payments, accept or decline quotes, and even return funds to the sender easily on the Money app or Online Banking.

Note: There are no limits to receiving international payments.

Who qualifies?

-

South African residents who are natural persons 18 years old or older and who have a Nedbank account

-

Non-South African residents who are natural persons 18 years old or older and who have a Nedbank account

-

Businesses that have a Nedbank account

How to receive an international payment

On the Money app

- Log in with your Nedbank ID, app PIN or fingerprint.

- Either swipe to the International banking dashboard or select transact and then pay.

- Select international payments.

- Select receive a payment.

- Follow the easy steps to complete the payment.

On Online Banking

- Log in with your Nedbank ID or QR code.

- Click on pay.

- Select international payments.

- Select receive a payment.

- Follow the easy steps to complete the payment.

What you need to know

The South African Reserve Bank has made changes to the settlement process of incoming international payments. From 1 July 2023, incoming international payments of less than R300,000 will not be settled automatically. You can easily finalise your payments via the Money app or Online Banking. T&Cs apply.

Restrictions

- Funds can be paid only into the account stipulated by the sender's bank.

- You can use the Money app or Online Banking only for payments into a Nedbank current or savings account.

- You have up to 30 days to accept the payment. If you do not accept it within this time, the payment will be returned to the sender.

- Exchange control regulations apply.

Additional information

- If you receive a payment from abroad every month for the same purpose [same balance-of-payment (BoP) category], such as a pension, you can contact the Nedbank Contact Centre on 0800 555 111 to have a standing instruction mandate set up. Your money will be converted automatically without any further action from you.

- If you would like to receive email notifications of incoming or outgoing cross-border payments as well as your debit and credit advices (copies of SWIFT MT103 standard payment messages), you can complete a Global e-Messenger Form and submit it to any Nedbank branch, or scan and email it to transactionalbankingmaintenance@nedbank.co.za if you have a fax or email indemnity in place.

Learn more about incoming international payments

Read FAQHassle-free international payments in a few quick taps

Transfer money worldwide with simple, convenient and secure international payments. Make international payments for business and personal transactions using the Money app or Online Banking.

Key features

Convenience

Make safe and reliable international payments or receive money from someone abroad anytime, from any device.

Simplicity

Funds are paid out directly from your Nedbank account into the recipient’s bank account.

Security

With a SWIFT transfer, you can easily pay for goods in another country or send money directly to people or businesses.

Who qualifies?

-

South African residents who are natural persons 18 years old or older and who have a Nedbank account

-

Non-South African residents who are natural persons 18 years old or older and who have a Nedbank account

-

Businesses that have a Nedbank account

Payments made easy

You can use your R1 million single discretionary allowance to make personal outgoing international payments from the comfort of your own home.

What you'll need

Individual payments

- Individual's name and surname

- Gender

- Full physical address

- Bank details including:

- their Bank's SWIFT code; and

- an international account number, bank account number or routing code, depending on their region.

Business payments

- Company name

- Full physical address

- Bank details including:

- their bank's SWIFT code; and

- an international account number, bank account number or routing code, depending on their region.

How to make an international payment

- Log on with your Nedbank ID, app PIN, fingerprint or Face ID.

- Select transact and then pay or swipe to international banking.

- Go to international payments.

- Select make a payment.

- Capture the recipient's details.

- Select the reason for payment.

- Enter the amount in rand or foreign currency.

- Accept or decline the quotation.

You can save the transaction and complete it later if you decline. All settled, in-progress and saved payments will appear in your payment history.

Limits

- South African residents over the age of 18 may use their R1 million discretionary allowance to make international payments without having to provide supporting documents.

- South African residents over the age of 18 may also use their R10 million investment allowance to invest in funds abroad. To make use of this allowance, you will need to get a tax compliance status PIN letter from the South African Revenue Service (SARS).

- The South African Reserve Bank (SARB) requires supporting documentation for all other payments.

Restrictions

- Exchange control regulations apply.

Additional information

- When you make an outgoing international payment to Australia, Canada, India or the United States of America, you must include the recipient's branch code. This is to make sure that the correct recipient receives their money on time.

- If you do not want to use the Money app, complete an application form, save it to your desktop and email the form to servicedeskpayments@nedbank.co.za. We will call you for verification. Please note: Depending on the reasons for payment (balance of payments or BoP), you may have to provide supporting documents. The email service is currently not available for business transactions.

- If you would like to receive email notifications of incoming or outgoing crossborder payments as well as your debit and credit advices (copies of SWIFT MT103 standard payment messages), you can complete a Global eMessenger Form and submit it to any Nedbank branch or scan and email it to transactionalbankingmaintenance@nedbank.co.za if you have a fax or email indemnity in place.

For more information, read the FAQs and Reason For Payments (Balance of Payment).

Click here to complete the Outgoing Payment Form

Due to an industry processing change, effective 9 September 2024, South African banks will no longer be able to facilitate payments to and receive payments from the Common Monetary Area (CMA) using the South African domestic payments EFT system. This means that you will need to use international payments to make payments to or receive payments from the CMA.

Use outgoing international payments to send money to friends and family, pay for goods and services or transfer funds to your offshore bank account. It is an easy, convenient and secure way to send money overseas for both business and personal transactions.

SARS APN

From 1 December 2023, you must provide a unique advance payment notification number for advance import cross-border payments that are related to your small-business services or commercial banking account.

Send or receive with Western Union

Make quick, secure payments globally with Western Union. Send or receive Western Union payments using the Money app or Online Banking and relax knowing your transactions are safe, secure and convenient.

Key features

Fast

When you need to send money urgently, Western Union provides quick transfers, with funds available for collection within minutes.

Secure

Western Union uses industry standard security measures that are trusted by millions and include tracking numbers for recipients.

Convenient

Bank anywhere, anytime using the Money app or Online Banking.

Here’s what you’ll need to use Western Union

-

A Nedbank current or savings account. Don’t have one? No sweat - you can get it here

-

A Nedbank ID. Download and register for one on the Money app now

-

Not a South African resident? No problem. Find out more

How to receive a payment with Western Union

On the Money app

- Log in with your Nedbank ID, app PIN, fingerprint or Face ID.

- Either swipe to the International banking dashboard or select transact and then pay.

- Select international payments.

- Select receive a payment.

- Follow the easy steps to complete the payment.

On Online Banking

- Log in with your Nedbank ID or QR code.

- Click on pay.

- Select international payments.

- Select receive a payment.

- Follow the easy steps to complete the payment.

How to make a payment with Western Union

- Log on with your Nedbank ID, app PIN, fingerprint or Face ID.

- Tap transact then pay, then international payments.

- Select send money, then Western Union.

- Select the account you’d like to pay from.

- Enter your recipient’s details.

- Enter the reason for the payment and the correct amount.

- Accept the quotations together with the terms and conditions.

- Accept the Approve-it message on your phone.

- Share the MTCN tracking number with the recipient.

On Online Banking

- Log on with your Nedbank ID or QR code.

- Click on pay and then international payments.

- Select send money, then Western Union.

- Select the account you’d like to pay from.

- Enter your recipient’s details.

- Enter the reason for the payment and the correct amount.

- Accept the quotations together with the terms and conditions.

- Accept the Approve-it message on your phone.

- Share the MTCN tracking number with the recipient.

Transfer limits

Your daily and monthly transfer limits may differ based on your status.

Status |

Daily limit (ZAR) |

Monthly limit (ZAR) |

|---|---|---|

R5,000 |

R25,000 |

|

R5,000 |

R25,000 |

|

No daily limit |

R80,000 |

Restrictions

Funds can be paid only into the account stipulated by the sender's bank.

You can use the Money app or Online Banking only for payments into a Nedbank current or savings account.

You have up to 30 days to accept the payment. If you do not accept it within this time, the payment will be returned to the sender.

Exchange control regulations apply.

Find out more

- Read frequently asked questions

- See terms and conditions

- See rates and fees

Help and support

Chat to Enbi - your 24/7 assistant

on the Money app or Online Banking

Chat to Enbi - your 24/7 assistant

on the Money app or Online Banking

Get the Money app

For a secure and convenient way to manage your money, open an account, get a loan, or even buy gift and prepaid vouchers: get the Nedbank Money app.