Use DebiCheck to make your debit orders safer

Use DebiCheck to make your debit orders safer

Staff writer

5 mins

Confirm your debit orders electronically to keep your money secure.

Many people are hesitant to add debit orders to their financial management tools. Some well-publicised scams, in which fraudulent operators load debit orders onto bank accounts without authorisation from accountholders, have left this payment option with an unreliable reputation.

This is unfortunate, because South African banks have made significant progress in the fight against debit order fraud with DebiCheck. But more importantly, debit orders can offer several benefits if you want to plan and stick to a monthly budget.

The benefits of a debit order

When you sign a debit order or authorise one over the phone, you give a vendor or service provider consent to withdraw a certain amount of money from your account every month. It makes recurring payments like a cellphone subscription, gym membership, insurance, home loan, car loan and so on much simpler. You don’t have to carry cash or pay in person.

Since a debit order runs on the same day every month, you can set it for a date when you know there’ll be money in your account, such as payday. This removes the worry that you might miss a payment, or that the debit order will be rejected due to insufficient funds – both of which would have a negative impact on your credit score.

Cybercrime: Why you always need to stay alert

By 2019, too many South Africans were falling prey to debit order fraud. The problem with the so-called ‘R99 scam’ was that fraudsters would load debit orders of less than R100 on victims’ accounts. Accountholders weren’t notified when such a small debit order was loaded and cybercriminals knew this. It could take months or even years for clients to notice the small extra debits on their accounts every month.

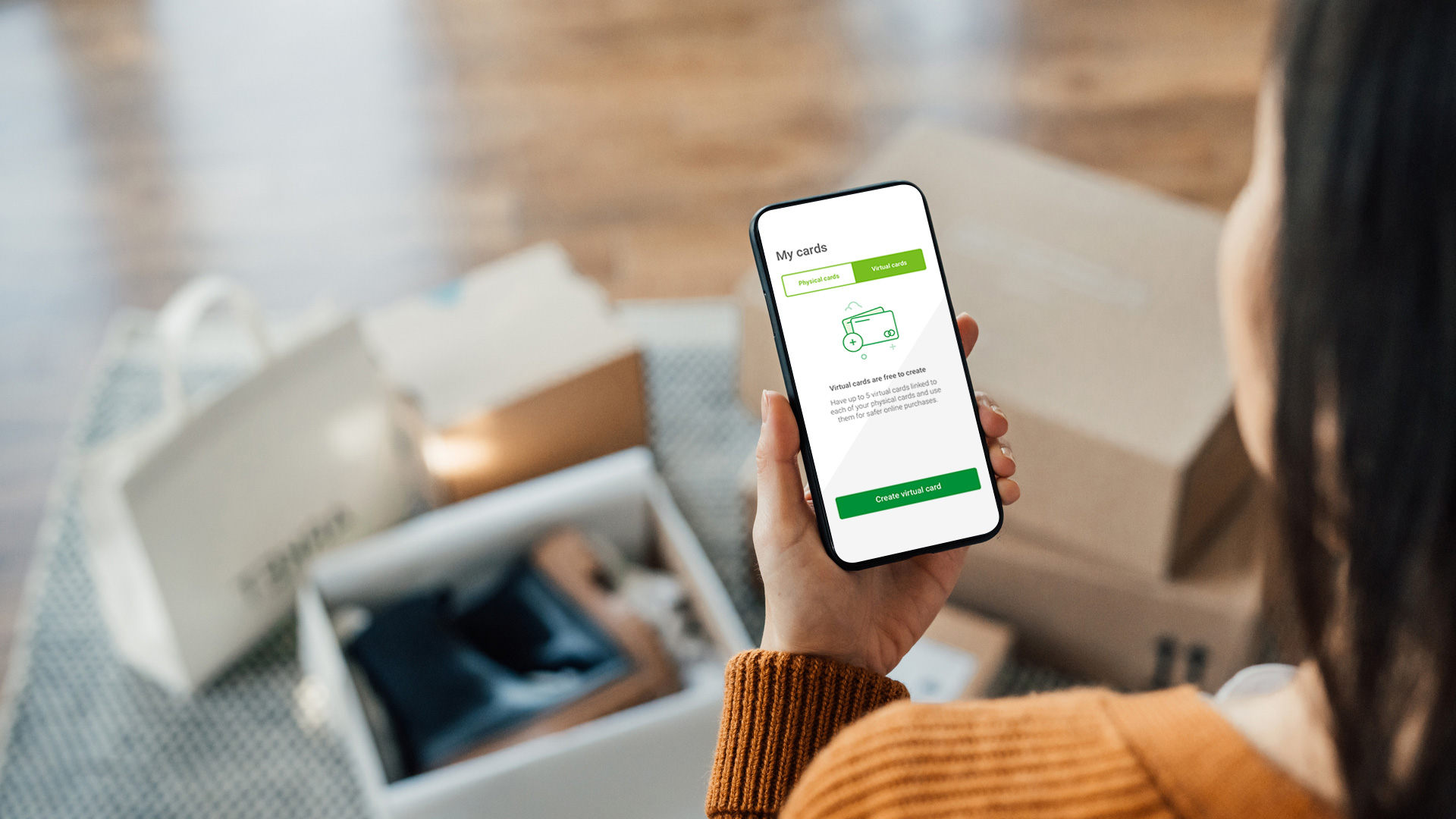

You can approve new debit order mandates easily and conveniently on the Money app, Cellphone Banking, Online Banking, or at an ATM

Even though it is possible to cancel a fraudulent debit order, accountholders had to be on high alert when checking their monthly statements, and getting back any money already stolen was a difficult and time-consuming process. It’s frustrating that it should be up to you to notice and cancel a debit order that you never authorised in the first place.

The Payment Association of South Africa decided to deal with debit order fraud head-on by introducing DebiCheck.

DebiCheck: Safe and convenient debit orders

DebiCheck is a system that sends you a notification to approve any new debit order information at the start of a contract. You’ll need to confirm online whether you have given permission to take money out of your account, and how much, before a new debit order can be loaded.

Through DebiCheck, Nedbank knows from the start what the terms of your contract are before allowing the debit order to go off. DebiCheck shows you who is taking money out of your account, making it easier to keep track of your payments and reducing debit order fraud.

Activating DebiCheck mandates

You can approve new debit order mandates easily and conveniently on the Money app, Cellphone Banking, Online Banking, or at an ATM. You can also call the Nedbank Contact Centre on 0800 555 111, or go into your nearest branch. If you find some suspicious debit orders on your account, you can reverse or stop them on the Money app.