Saving and investing money for the future are key. It makes sense to start nurturing the habit of saving and investing at an early age, for example when you start working. If you invest money for a long time, it grows due to the power of compound interest, meaning that you earn more interest on interest.

But you will have to pay tax on interest and any other returns on your investments, which can reduce your returns significantly. To help stimulate a culture of saving among South Africans, government introduced legislation in 2015, allowing tax-free savings via accredited financial services providers like Nedbank. You should consider them an essential part of a properly diversified investment portfolio.

How tax-free savings work

With tax-free savings, you don’t pay tax on interest, dividends or capital gains that you earn from your investments. Every South African can legally save up to R36,000 each year and R500,000 over their lifetime, but exceeding these limits will attract a 40% penalty fee on the additional contributions.

So, just like a standard unit trust investment, tax-free unit trusts enable you to invest in top-performing companies, with the potential to generate greater returns than you would have with an ordinary bank account over the long term. The key difference is that, unlike a standard unit trust, you don’t pay tax on interest, dividends or capital gains, which means your investment has the potential to grow faster.

If you’re new to investing, a tax-free unit trust is the ideal product to get you started

You can have tax-free savings on their own, or include them as part of your existing retirement and savings planning, to pay less tax on that portfolio. But even if you have multiple tax-free savings accounts at various financial institutions, you must stay within the total yearly savings limit of R36,000. It’s possible to transfer your tax-free savings from one institution to another.

Something to note about withdrawals

Tax-free savings also give you the flexibility to withdraw money when you need it. But remember, if you withdraw money and replace it later, it will count as a deposit – and if this deposit means you exceed your yearly limit, it will be considered an overcontribution for the year.

Say you contribute R36,000 over the year, but at some point you ‘borrow’ R10,000 and then pay it back. You’ll have added a balance of only R36,000 in total over the year, but as far as the South African Revenue Service is concerned, you have contributed R46,000 in total to the account. So, you will be liable for a 40% penalty on that R10,000.

Tax-free investments from Nedbank

Some of the tax-free products you may want to consider from Nedbank include:

- Tax-free fixed deposit account

- Tax-free savings account

- Tax-free unit trust investments

- Tax free investment offered on the Nedbank Wealth share-trading platform

If you’re new to investing, a tax-free unit trust is the ideal product to get you started. It all depends on your age and appetite for risk, because these investments are not guaranteed, but untaxed savings feel so much more rewarding and they’re a great motivator to keep you investing. The tax-free products in the Nedbank investment portfolio will enable you to build a balanced mix of investments at a single trusted institution.

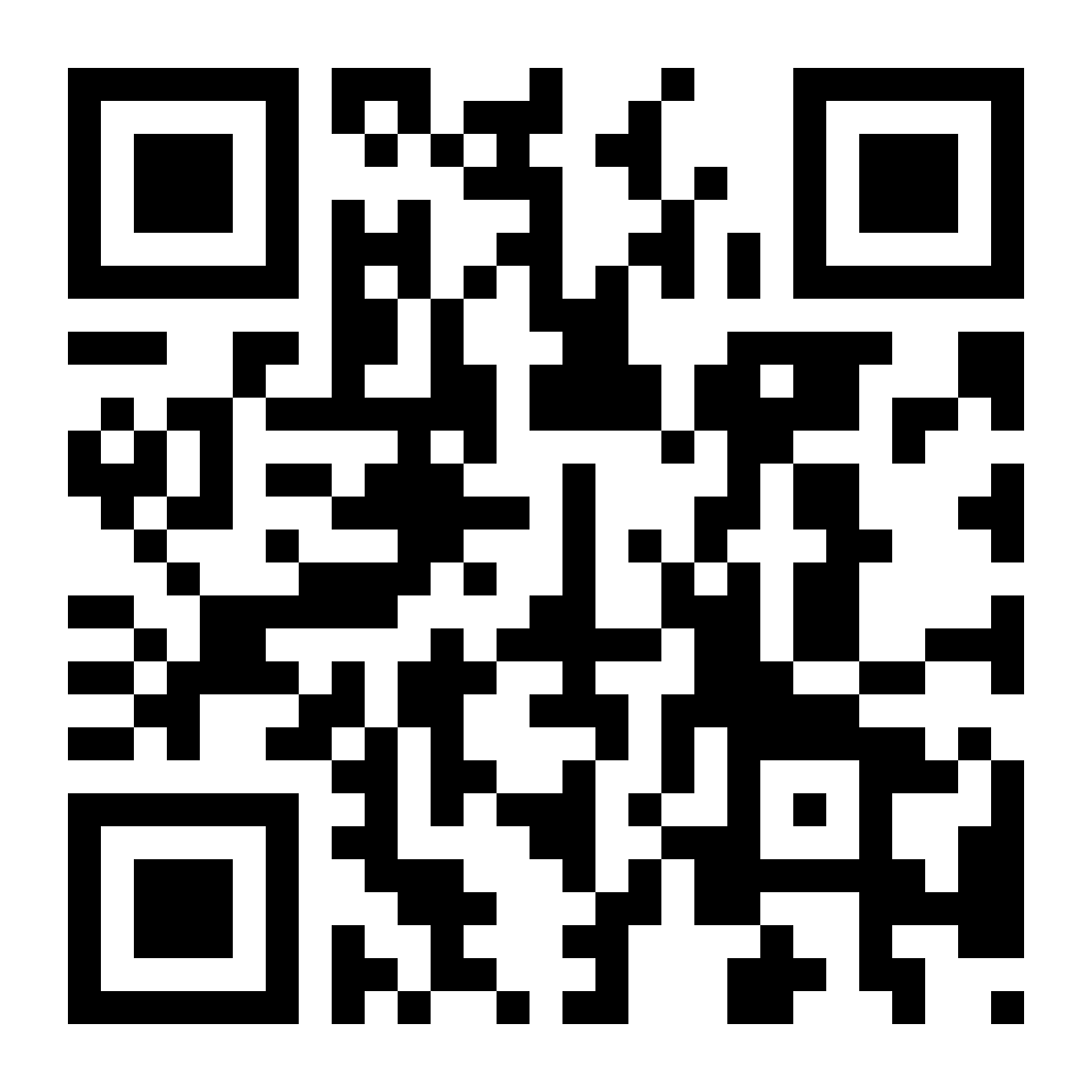

You can learn more about Nedbank’s savings and investment products, and find out what you need, and how to open an account. Or, you can scan the QR code below to open the Money app (or download the app if you don’t yet have it) and go to Tax-free investments, and select Get started to choose between a Tax-free Savings, Tax-free Fixed Deposit or Tax-free Unit Trust Investment account.

Choose your preferred tax-free savings or investment account in the Money app

Scan the QR code to easily open your choice of a Tax-free Savings, Tax-free Fixed Deposit or Tax-free Unit Trust Investment account in the Money app.