No queues, no hassles, no extra information... Just money in your account shap, shap.

Why use PayShap?

It’s safe

No need to carry cash, just PayShap it!

And it’s instant

Your money will be sent and received immediately.

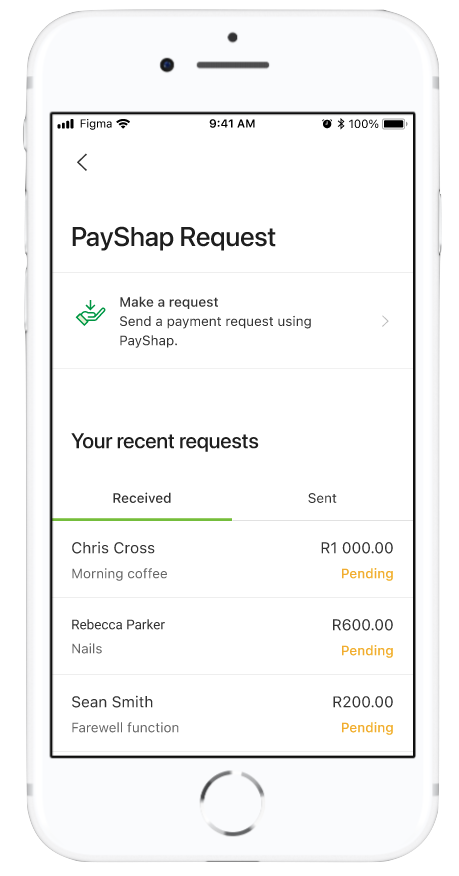

PayShap Request is here

Send and receive up to R50,000 a day instantly at participating banks. See steps on how to send PayShap Requests to the payer's account number using Money app or Online Banking.

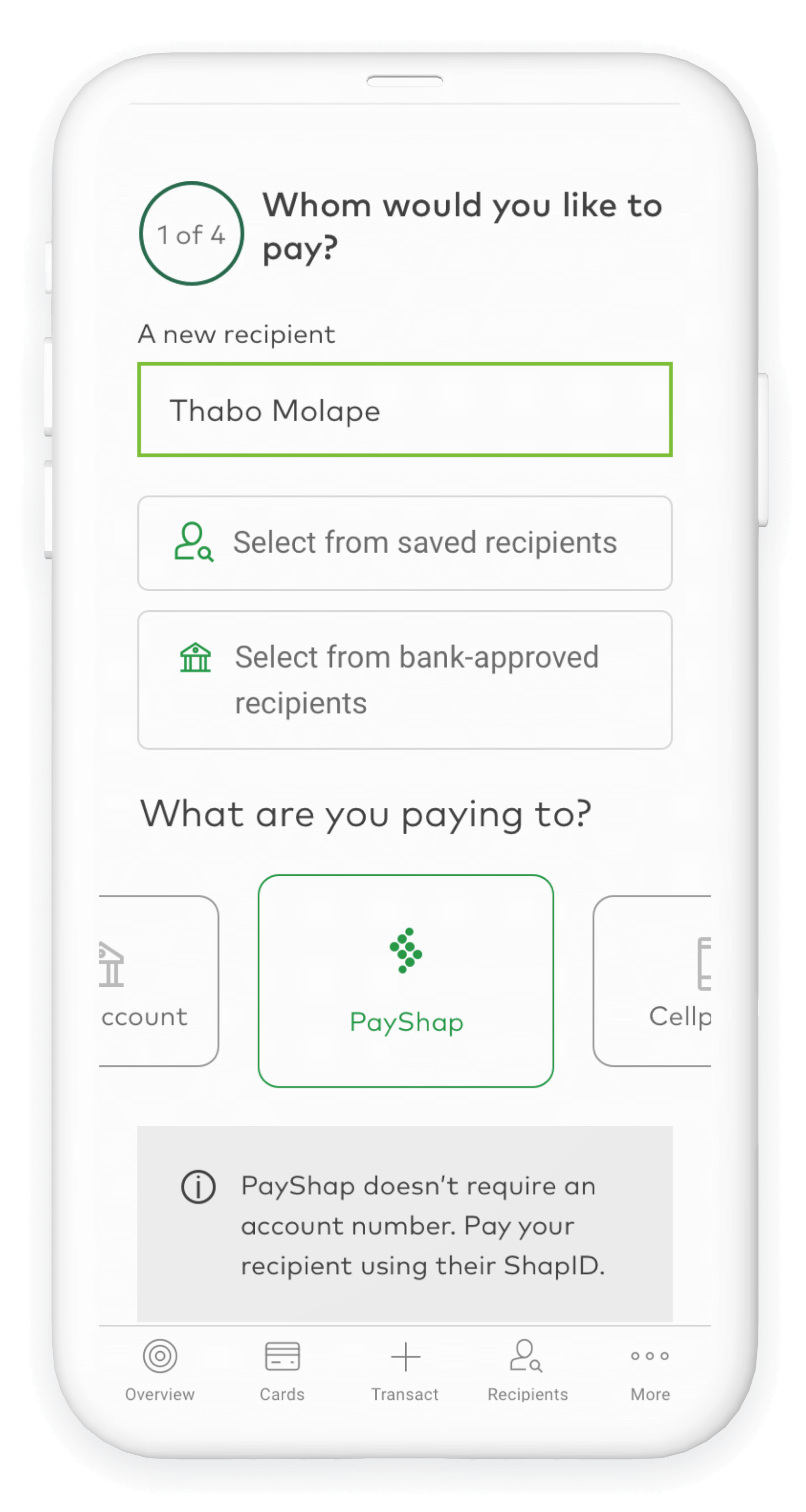

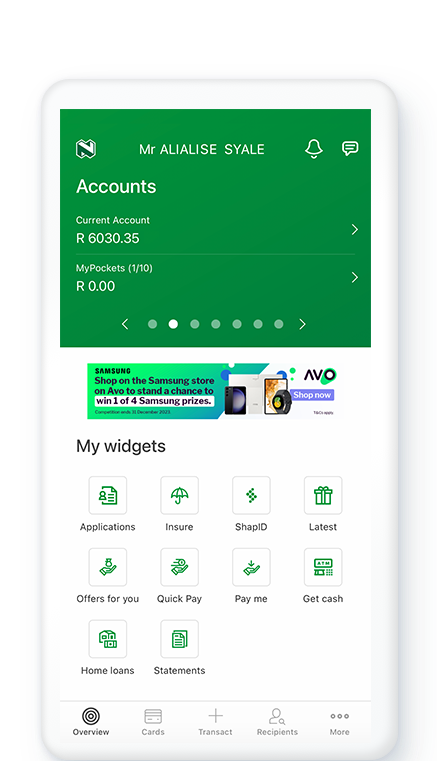

To use PayShap on the Money app

- Log on with your Nedbank ID, app PIN or FaceID.

- Select Pay and tap Single payment.

- Enter the recipient’s name and swipe to Pay to a ShapID.

- Enter their ShapID (making sure to pay the right person!)

- You can also Select from saved recipients and tap Pay to a ShapID if you've paid the same person before.

- Select Next and accept the terms and conditions.

- Enter the amount you want to send.

- Review the payment details.

- Select Pay and tap Finish.

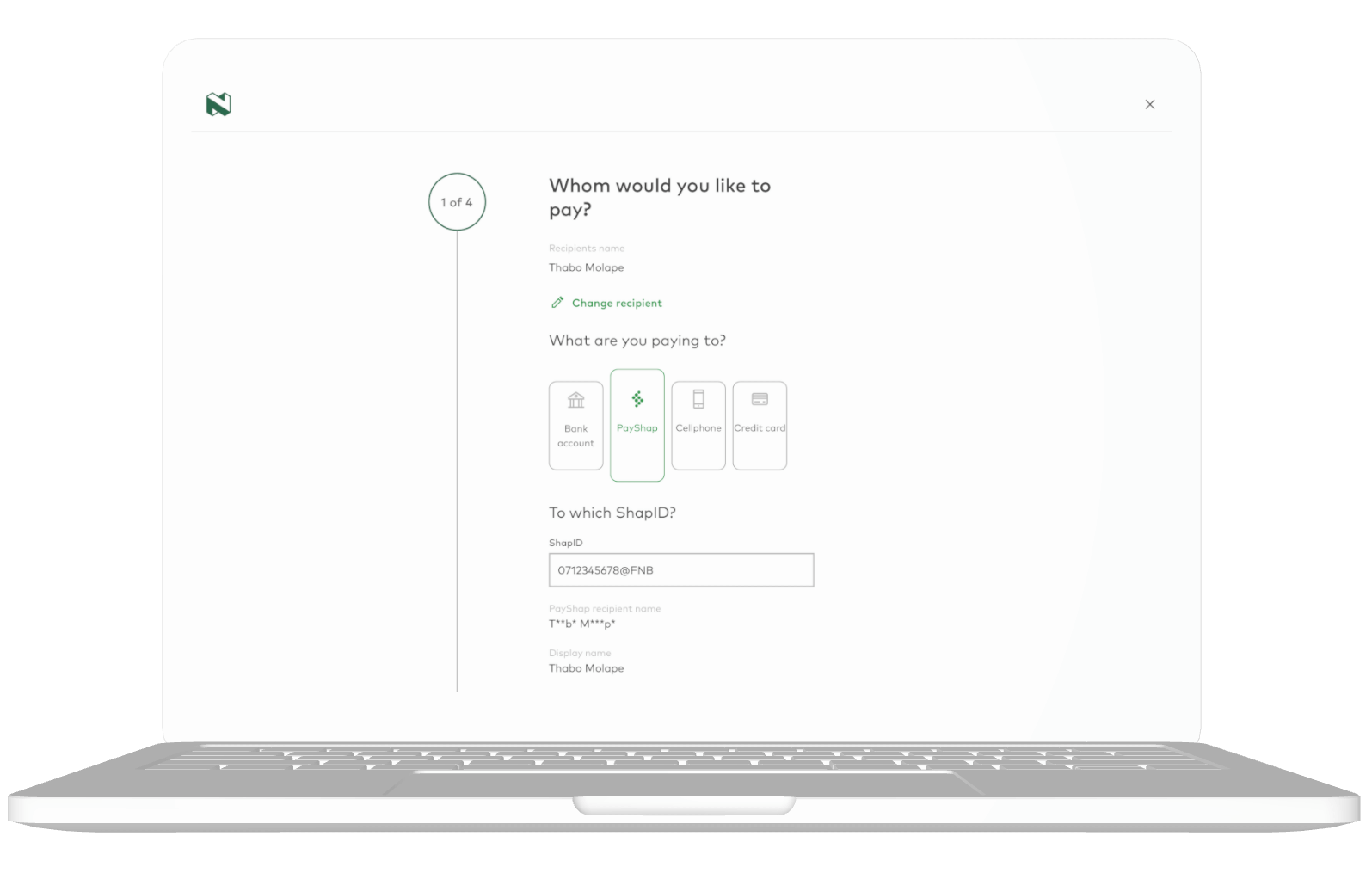

To use PayShap on Online Banking

- Log on to your Online Banking.

- Select Pay and tap Single payment.

- Enter the recipient’s name and swipe to Pay to a ShapID.

- Enter their ShapID (making sure to pay the right person!)

- You can also Select from saved recipients and tap Pay to a ShapID if you have paid the same person before.

- Select Next and accept the terms and conditions.

- Enter the amount you want to send.

- Review the payment details and select Pay.

- Read the note that appears and confirm by selecting Pay now.

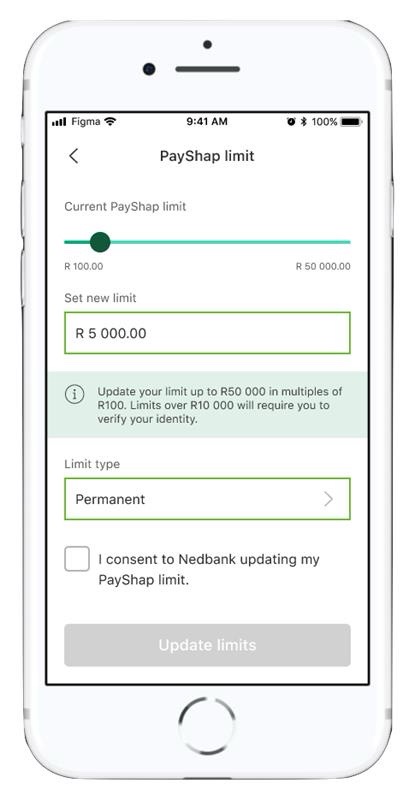

Need to increase your PayShap limit?

You can now increase your limit to up to R50 000 on the Money app or up to R10 000 on Online Banking.

Please note: Your PayShap limit cannot be more than your payment limit. If you want to increase your PayShap limit to an amount higher than your payment limit, please increase your payment limit first.

See steps on how to increase your PayShap limit.

How to register for a ShapID

To receive money instantly from other banks , you’ll first need to set up a ShapID by following these steps:

- Log in with your app PIN, fingerprint, or Nedbank ID.

- Select the PayShap widget then select Manage ShapID.

- Select Register a ShapID, and select the account you want to link your PayShap.

- Select Register.

For a full view on how to register, see our how-to guides.

It’s as simple as that. The recipient will get the money in seconds.

Need more info? Read the FAQ

Learn moreHelp and support

Chat to Enbi - your 24/7 assistant

on the Money app or Online Banking

Get the Money app

For a secure and convenient way to manage your money, open an account, get a loan, or even buy gift and prepaid vouchers: get the Nedbank Money app.

Get the Money app Learn more