It's all the banking you need and more at one monthly fee

Cash back on groceries

Up to 2% cash back on your grocery spend

Spouse discount

50% off your spouse’s monthly maintenance fees

Cash back on fuel

25c cash back for every litre of fuel at BP

Safe and secure banking - anytime from any device

With a MiGoals Plus account, you also get to enjoy the following

Track your money easily from any device

Set budgets, track your income and expenses and more for free with MoneyTracker – available on the Money app or Online Banking. We’ll help you manage your money and get you closer to your goals.

Earn interest with a free multi-savings pocket

Your MiGoals Account comes with a free MyPocket savings feature that allows you to set up and earn interest in up to 10 pockets. Transfer money easily between your account and savings pockets!

A 24/7 digital banking assistant

Our chatbot Enbi is there to give you all the online assistance you need at any hour of the day. Find Enbi on the Money app or your Online Banking profile.

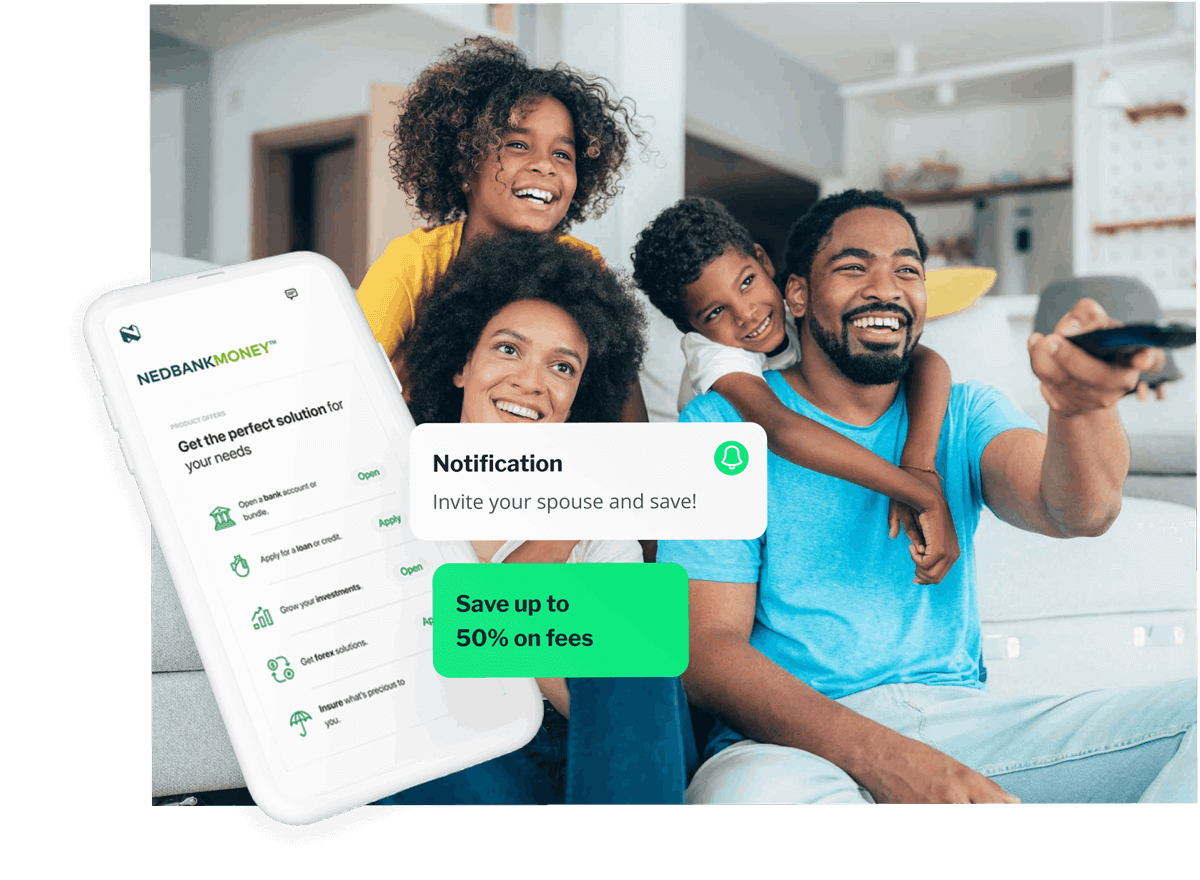

50% off your spouse's banking fees

Join Nedbank Family Banking for this and other benefits!

Invite your spouse to join your Nedbank Family Banking circle and save up to 50% on their monthly banking fees. You’ll also unlock a range of unlimited benefits for the both of you.

Free Greenbacks Rewards membership

Earn Greenbacks Rewards as you bank

MiGoals Plus comes standard with free Greenbacks Rewards membership. Simply sign up for Greenbacks when opening your account to earn great rewards every time you bank, save or find new ways of managing money well. Your Greenbacks Rewards will include a range of lifestyle deals and discounts from participating stores and partners.

Planning your next trip?

You can save on flights and accommodation, or pay less for your car rental with MiGoals Plus and Greenbacks Travel. Learn more here.

More accounts you may like

MiGoals

A super-affordable pay-as-you-use account.

R8 p/m

MiGoals Premium

Bank smarter with this full-package deal that offers you daily convenience, credit flexibility, and top-tier lifestyle benefits. Anyone 18 years or older can apply.

R250 p/m

See terms and conditions.

What you get

Rates and fees

Pay a monthly maintenance fee of only R99, or half that amount if you are 55 or older, or a youth aged between 18-26.

Link your account to Greenbacks for free and earn rewards as you bank.

Free in-app notifications.

Addtional transaction fees will apply. See our pricing guide.

Rewards and discounts

Get 50% off Nu Metro movie tickets.

Withdraw your Greenbacks as cash at any Nedbank ATM.

Enjoy Greenbacks Exclusive discounts on Avo SuperShop app.

Convenience and control

Enjoy 24/7 access to your account on our digital banking channels.

Switch your salary and debit orders easily on the Money app or Online Banking.

Check your balance at other banks’ ATMs, at home, or abroad.

Add an optional overdraft facility for only R69 a month.

Make unlimited, free cash withdrawals at participating stores.

Try our contactless payment options like QR codes or the tap-to-pay feature.

Security

Accept or reject transactions on your account with access to a 24/7 anti-fraud hotline.

Block, freeze or replace your card on the Money app, Online Banking, or our 24/7 call centre.

Set payment limits or activate and deactivate your cards as needed.

Enjoy the added security of our chip-and-PIN enabled cards.

Travel benefits

Enjoy Greenbacks Exclusive discounts on flights when you book through Greenbacks Travel on the Avo SuperShop.